The Race For Currency Control

We’re entering an arms race for who gets to control the currency

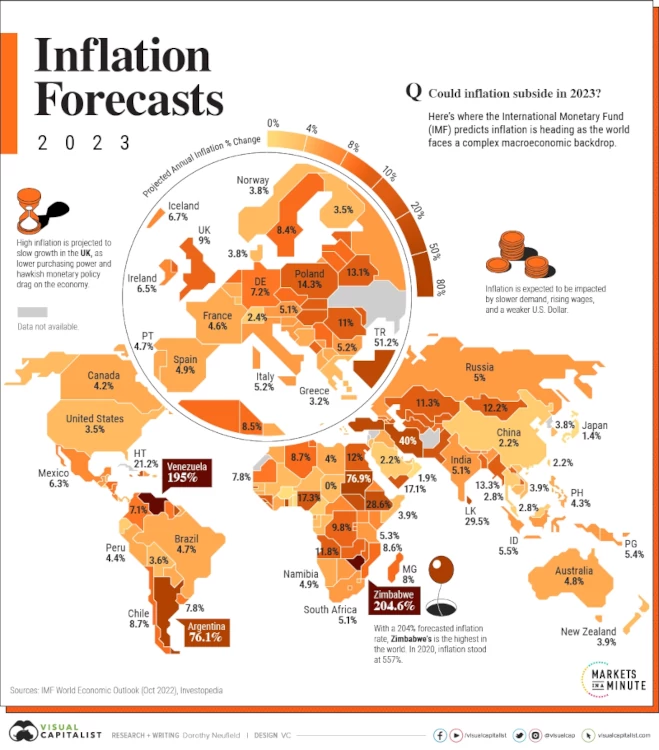

As the 3rd of the 4 biggest US banking collapses in history is happening today as I write this, and more powerful countries are leaving the US petrodollar to join BRICS which will be trading in the Yuan/Rubble, destabilziing USD even further. Any country which is reliant on a stable USD, or Central Banks, is having to make some very difficult decisions right now. This is on top of the inflation challenge affecting almost all of us.

Allegedly there are 21 countries who have expressed an interest in joining BRICS as of this month, it seems the list includes Argentina, Iran, Saudi Arabia, United Arab Emirates, Egypt, Algeria, Mexico, Nigeria, Syria, Tunisia, Afghanistan, Nicaragua, Senegal, Thailand, Turkey and Kazakhstan. Even Canada and Japan have been said to be interested. There does not appear to be set criteria for joining the BRICS, except, it seems, that the new members must be approved by the current five and have a sizable population. At this point, the most likely new members seem to be Argentina and Saudi Arabia.

This will begin a race to see who gets to control fiat currency; the government, the Central Bank, commercial banks, or the individual, are the current options. The first two will now heavily promote Central Bank Digital Currencies (CBDCs), suggesting it will stabalize things and prevent bank runs, but it will also introduce a financial surveillance network and the ability to cut anyone and everyone off of any transaction or access to their currency at a moment’s notice. The debate has begun in Canada.

The only self-sovereign option, the ability to empower the individual to control their own assets, is bitcoin. Not only is it not inflationary, it’s the only asset you can carry across borders. For those fleeing Ukraine for Poland for example, you’re not sneaking your gold, coins, and bills across the border with you. You can memorize 12 words, and effectively carry millions of dollars worth of bitcoin with you.

The state can both monitor and take away your house, block access to your bank account, and your CBDCs (even at the transaction level), and lock you out of your bitcoin if it’s on a regulated, centralized exchange – but no one can access your bitcoin but you, if you control the private keys to your bitcoin. It’s also important not to lose your private key as many have, the responsibility is now on you, there is no FDIC insurance if you failed to have a backup and you have an earthquake or tornado for example, your backup should be in another jurisdiction and secured.

At best, CBDCs are a surveillance and control heavy temporary stop gap, from inflation and destabilization of the US dollar.

You might live in a democratic nation state today, but that can change in an election, or earlier. The political tides can change can quickly, and that will increase as poverty, climate impacts, and displacement grows – and we become more polarized. I would prefer if we found leaders who actually led (by example and their actions) and unified us, but that’s not happening today.

If there is no separatation of money and government, governments are motivated to maintain power and control, to their own benefit.

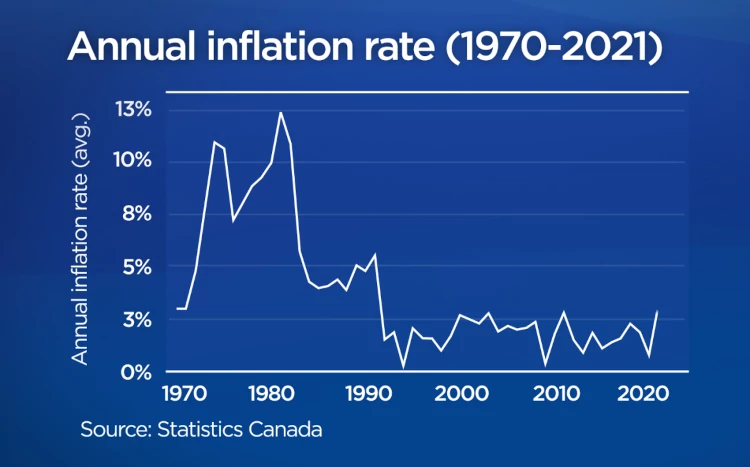

If you have say $1000 sitting in your bank account this year in Canada, it will be worth 4.2% less in a year, conservatively. This means you need to have your CAD in a vehicle making at least 4.3% this year, or you’re losing money, and your bank account is probably not doing that – it’s probably even costing you money when you consider monthly and transaction fees. If you compound this year on year, it will cause you to think what value your chequing or savings accounts are providing you.

If you look at it historically, in Canada as the example, where I live, we’re back to 1970 rates.

This is why bitcoin maxis have been recommending you leave fiat, and acquire bitcoin.

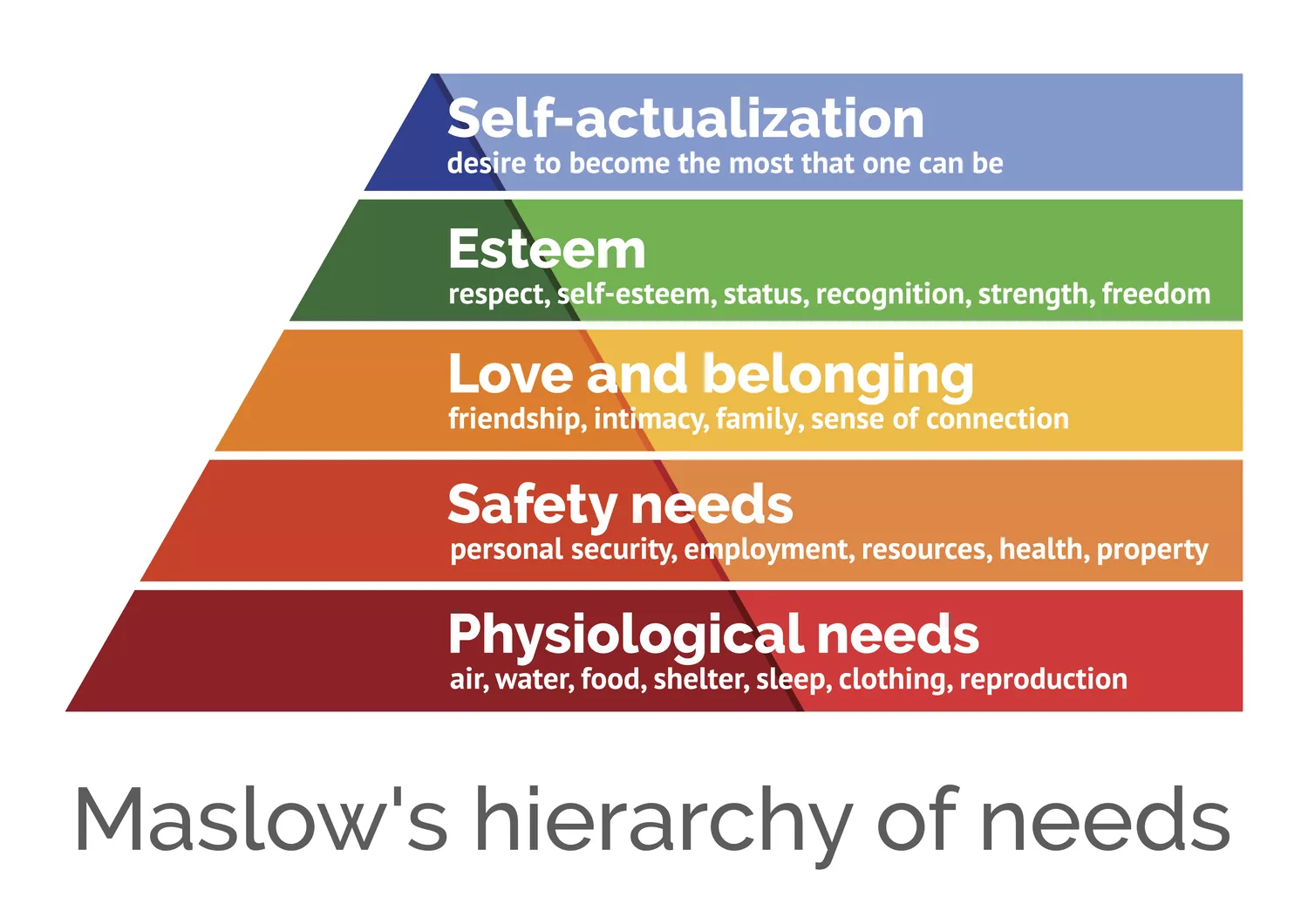

This post not not just about global macro economics, but also mental health & addiction. Anxiety is caused by fear of the future, and so to not have anxiety, you must have economic stability to have the two base layers of Maslow’s Hierarchy of Needs met, to also have hope for the future.

If you don’t have anxiety today, you have an excessive amount of privilege and should not only explore how those are surviving in the countries in the inflation map above, but you can even look around your own community.

On the micro, at the individual level, it’s a reminder, that we have to do the work to ensure we’re looking at the cup half full, and leading others to encourage them to do the same.

We’re in a global macro economic airplane who’s alarm is on and the oxygen masks have been deployed, for those who still have their headphones and sleeping masks on. We need to evaluate ourselves economically and mentally first until we’re glass half full, and then look to our neighbours and loved ones to show up as leaders and work towards solutions, instead of panicing or sitting idly by, should someone a little more selfish try to take control of the plane.

- How is your money working; is it for you, or against you?

- Should we, or can we, separate government from money?

- Who should control individual’s money?

Leave a comment