Impact Investment Economy

I started the year by talking about impact investing, and I thought it was a great subject to end off this year, where we’ve all been forced to reflect upon where our time, energy, and money is being spent. What is still needed for impact investment success is a trusted measurement of impact.

Enter the Impact Investment Economy

From an investment perspective, most older investors are still bottom line investors, in that profits & revenue are all that matter in an investment. As we all know, money itself doesn’t buy happiness, but attaching ourselves to our purpose surely does.

Every penny you invest, is a political statement on the world you want to live in. - Kris

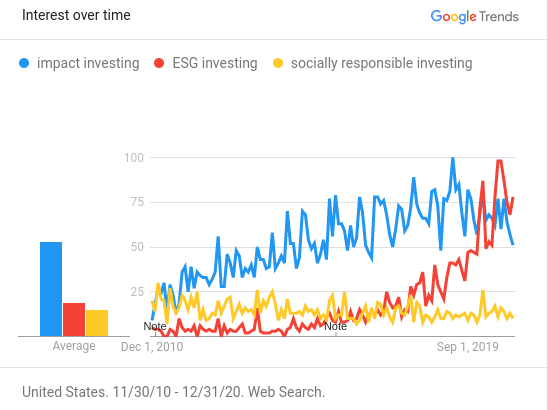

For the last decade, in my investor network, the trend has been moving towards impact. I will suggest there is a scale when leaving bottom line investing, and that starts with ESG, or Environmental, Social, and Governance which opens the door to reporting on the sustainability and societal impact of a business. As we move more progresssively from ESG we move into SRI, or Socially Responsible Investing which doesn’t just report, but seeks to have both a financial return but also a social or environmental good to bring about social change – SRIs also introduce the narrative of ethical investing. The most progresive option I know of that has the eye of investors I know is impact investing.

Impact investments are made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return1.

There are many companies working on investment vehicles in the impact space in traditional areas like ETFs, for example my friend Andrew of Change Finance has a U.S. Large Cap Fossil Fuel Free ETF called CHGX. (This is not an endorsement or investment advice). It’s worth checking out their website, as they make it very clear through their ESG criteria which verticals they are excluding from their portfolio. Most notably what we will see from those who identify as ethical investors, as “sin stocks”. My focus is more in the entrepreneurial and innovation space, specifically in investable companies are are interested in impact.

All of these have been progressing since they introduced the hybrid social enterprise structure here in British Colombia, called the Community Contribution Company or C3 which never caught on for a few different reasons I won’t discuss here. I now have several friends who’ve left bottom line investing, as well as know several friends who’ve moved into the investing world over the last couple of decades, and all of them are talking about impact investing in some form.

Not only are the older generation paying more attention to this, the younger generation of investors, the privelged Millenials and Gen Z folks who are having wealth allocated to them at an unignorable rate – over $68 trillion by 2030 according to Forbes.

What tools are in place for evaluating these new impact investment options? Well, the four big auditing firms have introduced ESG reporting standards this fall. As you likely know if you read my blog, I always like to look into the future, and I predict impact investing will be there and not ignorable. What I realize though, is there are very few standards and processes in place for this. Right now, the only major impact milestones an investable company can make that are guaranteed to raise attention are being certified a b corporation or if they’re really ambitious, they’re focused on solving a UN SDG United Nations Sustainable Developement Goal.

The current gap that is uniform across impact investors is lack of standardization in reporting and auditing, and that’s what I’m working on. What I’m looking for in writing this are investable companies that are already focused on impact, or they want to learn how to start reporting on impact to attract impact investors. Over the next few months I’ll be able to announce a few partner investment companies, from impact investors in private equity (PE) as well as debt financing, to family offices who’ve agreed to enter our beta program where they can evaluate the efficacy of both the finances as well as the impact of investable as well as invested-in companies.

Now that I have the attention of investors who are interested in moving their portfolio into our impact dashboard, I want to start to build a database of investable companies, and help them report on impact in a way that will pass the due diligence filters of my investor network to help these companies get money faster and easier.

If you know anyone with an equity ownership in an investable company, please have them fill out this contact form and I will reach out to them within 2 business days. If you’re an investor who’s already in impact, or interested in impact investing, please also reach out and I will follow-up.

Leave a comment