Silicon Valley Bank Closing And Impact On The Petrodollar

The biggest argument against bitcoin by fiat (petrodollar) fans has been FDIC insured banks are trustworthy, reliable, and backed so they won’t fail. Today, the biggest startup bank fell, which was FDIC insured. Silicon Valley Bank (SVB) is locked as of today. From huge companies like Uber, Tesla, AirBnB, to tiny startups, if your deposits went to SVB, you’re locked out of your funds. Raised 50 million yesterday for your company and the deposit went to SVB? Your company has now folded.

No one knows who all uses SVB, best we have is ChatGPT from 2021. The impact is already noticable a few hours later. Keynesian economics and government economics are no longer in play, ~$209 Billion dollars impacted over ~65000 startups.

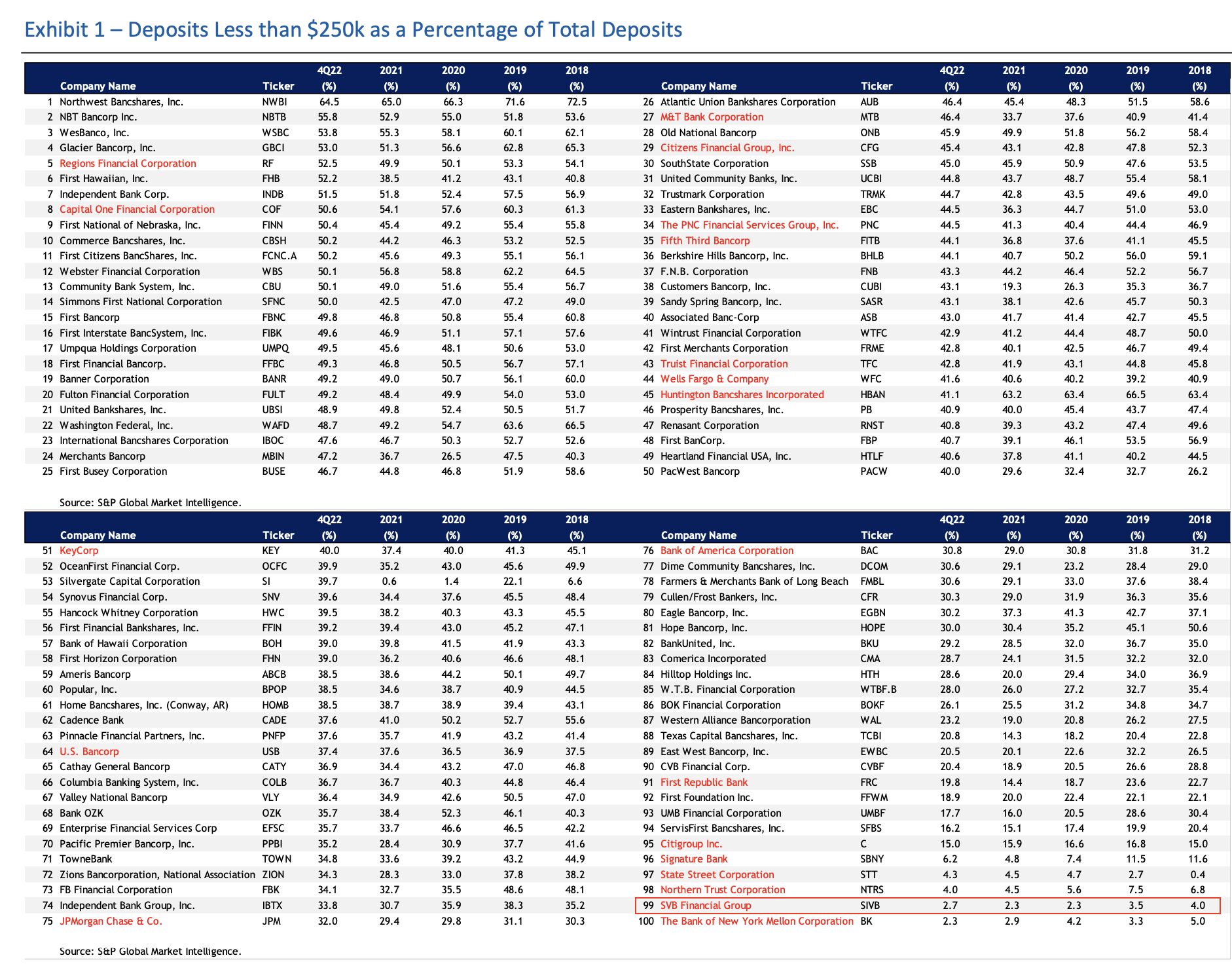

Only 2.7% of Silicon Valley Bank deposits are less than $250,000. Meaning, 97.3% aren’t FDIC insured.

If you’re a VC backed startup, now is when you will realize how much value your VC is able to provide. They should have already assured you you’ll be fine, their lack of stability wasn’t your fault, and it’ll also be worth watching how much credit they want to recieve publicly for doing their job in this regard.

It’s hard to under state the impact today’s new will have. The ripple effects will be staggering. It will be hard to raise money for years to come as the best possible outcome. The really challenging fear is a bank run, or domino effect – if you get fearful of your bank today, and ~5% of funds are withdrawn, your bank will close down and you’ll be locked out as well, as banks haven’t had to back their held funds since ~1971.

It is worth reflecting how you are hedging from your fiat and/or your bank closing down today. I’m in Austin for SXSW, and AirBnB and Uber could be impacted by Monday as they just lost access to capital, if the US government doesn’t offer a safe sounding bailout (well, technically the insurance fund the banks use, controlled by the government).

The petrodollar has already been challenged by the U.S. sanctioning Russia, as now Russia, China, and India have agreed to leave the U.S. dollar for oil exchange, but the 5EYES countries participating in quantitative easing as a hobby hasn’t helped things either – the inflationary bubble makes Chinese spy ballons appear like a childs toy in comparison.

I empathize with policy makers in the 5EYES countries today, do they let SVB fall or bail them out and start to treat banks like hedge funds? Our economy relies on the trust of a stable economic system, and today it’s being challenged in a way that we can’t ignore.

If you’re in Canada, you can buy bitcoin in 2 minutes and while bitcoin is a small hedge, the ripple effects of today will be in the history books, so plan accordingly.

While I support custodial wallets for their ease of friction for new users and for wallet level amounts, if you’re treating bitcoin with bank level funds, it’s a good day to understand what non-custodial and cold wallets mean.

As always, our mental health is our main priority in a world of such economic disparity, so if you can, get some sun, meditate, and chat with those you love or who bring you joy.

Leave a comment